Best finance apps are revolutionizing the way we manage our money. From budgeting and investing to tracking expenses and integrating with other financial accounts, these apps empower users to take control of their finances like never before. Dive into our comprehensive guide to discover the top finance apps, their key features, and how they can help you achieve your financial goals.

Finance apps have become indispensable tools for individuals and businesses alike, offering a wide range of functionalities tailored to specific needs. Whether you’re looking to optimize your budget, make informed investment decisions, or streamline your expense tracking, there’s a finance app that can meet your requirements.

Popular Finance Apps

Finance apps have become increasingly popular in recent years, offering a range of features to help users manage their finances more effectively. These apps can track spending, create budgets, set financial goals, and even invest. They are designed to make it easier for users to take control of their finances and improve their financial health.

There are a number of different finance apps available, each with its own unique set of features. Some of the most popular finance apps include:

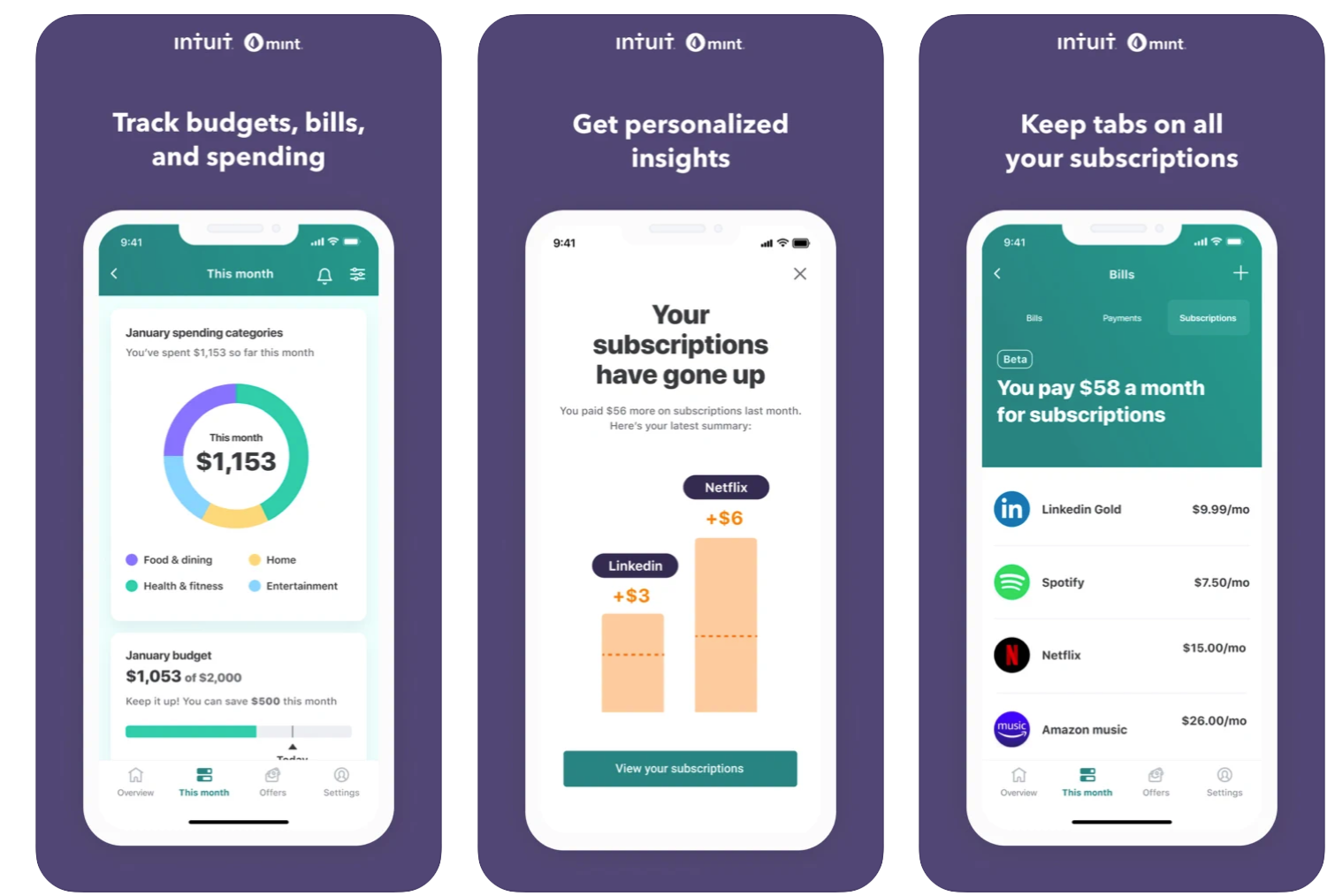

- Mint: Mint is a free finance app that offers a comprehensive range of features, including budgeting, spending tracking, bill payment, and investment tracking.

- YNAB (You Need a Budget): YNAB is a paid finance app that focuses on helping users create and stick to a budget. It offers a number of features to help users track their spending, identify areas where they can save money, and make better financial decisions.

- Personal Capital: Personal Capital is a free finance app that offers a comprehensive view of a user’s financial situation. It includes features such as budgeting, investment tracking, and retirement planning.

- Acorns: Acorns is a micro-investing app that allows users to invest their spare change automatically. It is a great way for beginners to start investing.

- Robinhood: Robinhood is a commission-free stock trading app that makes it easy for users to buy and sell stocks. It is a great option for experienced investors who want to trade stocks without paying high fees.

Finance apps can offer a number of benefits to users, including:

- Convenience: Finance apps can be accessed from anywhere, at any time. This makes it easy for users to track their spending, create budgets, and make financial decisions on the go.

- Automation: Finance apps can automate a number of tasks, such as tracking spending, creating budgets, and paying bills. This can save users a lot of time and hassle.

- Insights: Finance apps can provide users with insights into their financial behavior. This can help users identify areas where they can improve their financial habits.

However, there are also some drawbacks to using finance apps. These include:

- Security: Finance apps store sensitive financial information, so it is important to choose an app that has strong security measures in place. Users should also be careful not to share their login information with anyone.

- Fees: Some finance apps charge fees for certain features, such as investment tracking or budgeting. Users should carefully consider the fees before choosing an app.

- Accuracy: Finance apps rely on users to input their financial data accurately. If users make mistakes when entering data, it can affect the accuracy of the app’s insights.

Overall, finance apps can be a valuable tool for managing finances. However, it is important to choose an app that is right for your needs and to be aware of the potential risks involved.

Security Measures

Finance apps store sensitive financial information, so it is important to choose an app that has strong security measures in place. These measures should include:

- Encryption: The app should encrypt all user data, both at rest and in transit. This ensures that the data is protected from unauthorized access.

- Multi-factor authentication: The app should require users to use multi-factor authentication when logging in. This adds an extra layer of security and makes it more difficult for hackers to access user accounts.

- Regular security updates: The app should be regularly updated with the latest security patches. This helps to protect the app from vulnerabilities that could be exploited by hackers.

Users should also be careful not to share their login information with anyone. They should also create a strong password and change it regularly.

Types of Finance Apps: Best Finance Apps

Finance apps come in various forms, each tailored to specific financial needs and target audiences. Categorizing them based on functionality provides a clearer understanding of their capabilities and the individuals they serve.

The primary types of finance apps include:

Budgeting Apps

Budgeting apps empower users to track income and expenses, create budgets, and monitor their financial progress. They provide insights into spending patterns, helping individuals make informed decisions and stay within their financial means. Popular budgeting apps include Mint, YNAB (You Need a Budget), and EveryDollar.

Investing Apps

Investing apps facilitate the purchase and sale of stocks, bonds, and other investment products. They offer user-friendly interfaces, research tools, and portfolio management features. These apps cater to both beginner and experienced investors, making it easier for individuals to manage their investments and grow their wealth.

Examples include Robinhood, Acorns, and Stash.

Expense Tracking Apps

Expense tracking apps allow users to record and categorize their expenses. They provide a comprehensive view of spending habits, enabling individuals to identify areas where they can save money and optimize their financial situation. Popular expense tracking apps include Expensify, PocketGuard, and Wally.

Credit Monitoring Apps

Credit monitoring apps provide real-time updates on credit scores, credit reports, and financial alerts. They help users stay informed about their creditworthiness and take proactive steps to improve or maintain their credit health. Examples of credit monitoring apps include Credit Karma, Experian, and Equifax.

Financial Planning Apps

Financial planning apps offer a comprehensive suite of tools to help individuals plan for their financial future. They provide retirement planning, tax optimization, and estate planning features. These apps are designed to guide users through complex financial decisions and ensure they are on track to achieve their long-term financial goals.

Popular financial planning apps include Personal Capital, Wealthfront, and Betterment.

Features to Consider

Choosing the right finance app requires careful consideration of its features. Essential elements to look for include budgeting tools, investment options, and expense tracking capabilities. Additionally, user interface, compatibility, and customer support play crucial roles in enhancing the user experience.

Evaluating Effectiveness

Evaluating the effectiveness of finance app features is essential. Consider factors such as:

- Ease of Use:The app should be intuitive and easy to navigate, allowing users to quickly access and manage their finances.

- Customization:The app should offer customization options to cater to individual needs and preferences, such as personalized budgeting categories or investment strategies.

- Integration:The app should integrate seamlessly with other financial accounts, such as bank accounts and credit cards, for comprehensive financial management.

- Security:The app should prioritize data security and employ robust encryption measures to protect user information.

Integration and Compatibility

Integrating finance apps with other financial accounts provides a comprehensive view of your financial situation and streamlines money management. It allows you to track transactions, monitor spending, and manage budgets across multiple accounts in one place.

Different integration methods offer varying levels of connectivity and user experience. Open Banking APIs enable secure data sharing between banks and third-party apps, providing real-time access to account balances and transaction history. Screen scraping involves the app accessing your online banking portal and extracting data, but it may be less secure and less reliable.

Successful Integrations

Successful integrations include:

- Mint: Aggregates data from multiple accounts, including banks, credit cards, and investments.

- Personal Capital: Provides a holistic view of your financial health, including investment tracking and retirement planning.

Challenges

Potential challenges include:

- Data security: Ensure the app uses secure encryption and authentication protocols.

- Compatibility: Verify that the app is compatible with your financial institutions and devices.

- Limited functionality: Some integrations may only offer basic features, such as transaction tracking, while others provide more advanced capabilities like budgeting and investment management.

Security and Privacy

Finance apps handle sensitive financial data, making security and privacy paramount. Users should prioritize apps with robust security measures.

Essential security features include encryption to protect data in transit and at rest, two-factor authentication for added login protection, and fraud protection to detect and prevent unauthorized transactions.

Potential Risks and Vulnerabilities, Best finance apps

Despite security measures, finance apps may face risks, such as:

- Data breaches: Hackers can exploit vulnerabilities to access sensitive data.

- Malware: Malicious software can compromise devices and steal financial information.

- Phishing: Scammers impersonate legitimate apps to trick users into revealing login credentials.

Emerging Trends

The finance app industry is constantly evolving, with new technologies emerging all the time. Artificial intelligence (AI) and machine learning (ML) are two of the most important trends that are shaping the future of finance apps.AI and ML can be used to automate a variety of tasks, from managing finances to providing personalized advice.

This can save users time and money, and it can also help them make better financial decisions.Here are a few examples of innovative finance apps that are leveraging AI and ML:

Mint

Mint is a budgeting app that uses AI to track spending, create budgets, and provide personalized financial advice.

Acorns

Acorns is an investing app that uses AI to help users invest their spare change.

Robinhood

Robinhood is a trading app that uses AI to provide real-time stock market data and insights.These are just a few examples of the many ways that AI and ML are being used to improve finance apps. As these technologies continue to develop, we can expect to see even more innovative and groundbreaking apps emerge.

Final Conclusion

In the ever-evolving landscape of finance, apps continue to push the boundaries of innovation. By leveraging emerging technologies like artificial intelligence and machine learning, these apps are transforming the way we interact with our finances. As we look towards the future, we can expect even more groundbreaking advancements that will redefine the role of finance apps in our lives.

Helpful Answers

What are the benefits of using finance apps?

Finance apps offer numerous benefits, including improved budgeting, simplified expense tracking, personalized investment recommendations, and enhanced security measures.

How do I choose the best finance app for my needs?

Consider your specific financial goals, the features you require, and the user interface that suits you best. Read reviews, compare features, and try out different apps to find the one that meets your needs.

Are finance apps secure?

Reputable finance apps implement robust security measures such as encryption, two-factor authentication, and fraud protection to safeguard your financial data.