Financial advisor apps are revolutionizing the way we manage our finances. These powerful tools offer personalized advice, tailored investment strategies, and cutting-edge security, making it easier than ever to achieve your financial goals.

From tracking expenses to planning for retirement, financial advisor apps empower you with the knowledge and support you need to make informed financial decisions.

Overview of Financial Advisor Apps

Financial advisor apps are digital platforms that provide financial planning and investment advice to individuals and families. These apps leverage technology to make financial advice more accessible, affordable, and personalized.

Using financial advisor apps offers several benefits, including:

- Convenience: Apps provide 24/7 access to financial advice from anywhere with an internet connection.

- Affordability: Many apps offer low-cost or subscription-based services, making financial advice more accessible to a wider range of individuals.

- Customization: Apps can be tailored to individual financial goals, risk tolerance, and investment preferences.

- Automation: Apps can automate tasks such as investment tracking, portfolio rebalancing, and tax-loss harvesting, saving time and effort.

However, there are also challenges associated with using financial advisor apps:

- Lack of human interaction: Apps cannot provide the same level of personalized advice and emotional support as a traditional financial advisor.

- Limited investment options: Some apps may have a limited selection of investment options compared to traditional advisors.

- Potential for bias: Apps may have inherent biases towards certain investment products or strategies.

Examples of popular financial advisor apps include:

- Betterment

- Wealthfront

- SoFi Invest

- Acorns

- Stash

Features of Financial Advisor Apps

Financial advisor apps are designed to provide users with personalized financial advice and guidance. They offer a range of features to help users manage their finances, make informed investment decisions, and plan for the future.

The core features of financial advisor apps typically include:

- Financial planning:Helps users create and manage financial plans, including budgets, savings goals, and retirement planning.

- Investment management:Provides tools for users to track and manage their investments, including stocks, bonds, and mutual funds.

- Financial advice:Offers personalized financial advice from certified financial advisors, covering topics such as debt management, tax planning, and estate planning.

- Financial education:Provides educational resources and articles on financial topics to help users improve their financial literacy.

- Account aggregation:Allows users to connect their financial accounts in one place, providing a consolidated view of their financial situation.

Types of Financial Advice Provided by Financial Advisor Apps

Financial advisor apps provide a range of financial advice, including:

- Investment advice:Helps users make informed investment decisions, including choosing the right investments, diversifying their portfolio, and managing risk.

- Retirement planning:Provides guidance on saving for retirement, choosing retirement accounts, and managing retirement income.

- Debt management:Offers advice on managing debt, including consolidating debt, negotiating with creditors, and creating a debt repayment plan.

- Tax planning:Provides guidance on minimizing taxes, including choosing the right tax deductions and credits, and planning for tax-efficient investments.

- Estate planning:Helps users plan for the distribution of their assets after death, including creating wills, trusts, and powers of attorney.

Investment Strategies and Tools Offered by Financial Advisor Apps

Financial advisor apps offer a range of investment strategies and tools to help users achieve their financial goals. These may include:

- Goal-based investing:Helps users create and manage investment portfolios tailored to specific financial goals, such as retirement, education, or a down payment on a house.

- Risk management:Provides tools to help users manage risk in their investment portfolios, including diversification, asset allocation, and stop-loss orders.

- Tax-efficient investing:Offers guidance on choosing investments that minimize taxes, such as municipal bonds, tax-loss harvesting, and Roth IRAs.

- Robo-advisors:Automated investment management services that use algorithms to create and manage investment portfolios based on users’ risk tolerance and financial goals.

- Investment research:Provides access to investment research and analysis tools to help users make informed investment decisions.

User Experience and Accessibility: Financial Advisor Apps

Financial advisor apps prioritize user experience to enhance the overall usability and satisfaction of the users. The interface is designed to be intuitive and user-friendly, with clear navigation menus and well-organized dashboards that provide quick access to relevant information. These apps are also optimized for different devices, ensuring a seamless experience across smartphones, tablets, and desktops.Accessibility features are incorporated to cater to users with diverse needs.

These features include adjustable font sizes, high-contrast color schemes, and screen reader compatibility. Additionally, many apps offer customizable settings that allow users to tailor the interface to their preferences and requirements.

Personalization and Customization

Financial advisor apps personalize financial advice by leveraging advanced algorithms and machine learning to analyze a user’s financial data, including income, expenses, investments, and financial goals. Based on this analysis, the app can provide tailored recommendations and insights specific to the user’s individual circumstances.Customization options allow users to further personalize their experience with financial advisor apps.

These options typically include the ability to set financial goals, track progress towards those goals, and receive personalized notifications and alerts based on their preferences. By tailoring financial advice to individual needs, these apps empower users to make informed financial decisions and achieve their financial goals more effectively.

Importance of Tailoring Financial Advice

Tailoring financial advice to individual needs is crucial because every person’s financial situation is unique. A one-size-fits-all approach to financial planning can be ineffective or even detrimental to achieving financial goals. By personalizing advice, financial advisor apps ensure that users receive guidance that is relevant to their specific circumstances, risk tolerance, and investment objectives.

This level of personalization helps users make informed decisions and avoid costly financial mistakes.

Security and Data Protection

Financial advisor apps prioritize the security of user data and financial information. They implement robust security measures to protect against unauthorized access, data breaches, and cyber threats.These apps typically employ multi-factor authentication, encryption protocols, and secure cloud storage solutions to safeguard sensitive data.

They also adhere to industry-standard data protection protocols, such as the Payment Card Industry Data Security Standard (PCI DSS), to ensure compliance with regulatory requirements.

Data Encryption

Financial advisor apps use encryption algorithms to protect user data during transmission and storage. Encryption transforms data into an unreadable format, making it inaccessible to unauthorized individuals.

Authentication and Authorization

These apps implement multi-factor authentication mechanisms, such as two-factor authentication (2FA) and biometrics, to verify user identity and prevent unauthorized access to accounts.

Regulatory Compliance

Financial advisor apps are subject to regulatory oversight and must comply with industry standards and best practices. They undergo regular audits and security assessments to ensure compliance with regulations and protect user data.

Integration and Compatibility

Financial advisor apps offer seamless integration with a wide range of financial tools and services, including budgeting apps, investment platforms, and tax preparation software. This integration allows users to import their financial data into the app, track their progress, and receive personalized advice based on their unique financial situation.The compatibility of these apps with different devices and platforms is crucial for accessibility and convenience.

Most financial advisor apps are available for both iOS and Android devices, as well as desktop and web-based platforms. This ensures that users can access their financial information and advice from any device, anytime, anywhere.Seamless integration and compatibility offer several benefits for financial management.

By integrating with other financial tools, advisor apps can provide a comprehensive view of a user’s financial health, identify areas for improvement, and automate tasks such as budgeting and investment tracking. Compatibility with different devices and platforms allows users to access their financial information and advice from any device, making it easier to stay on top of their finances.

Supported Integrations

Financial advisor apps typically offer integrations with the following financial tools:

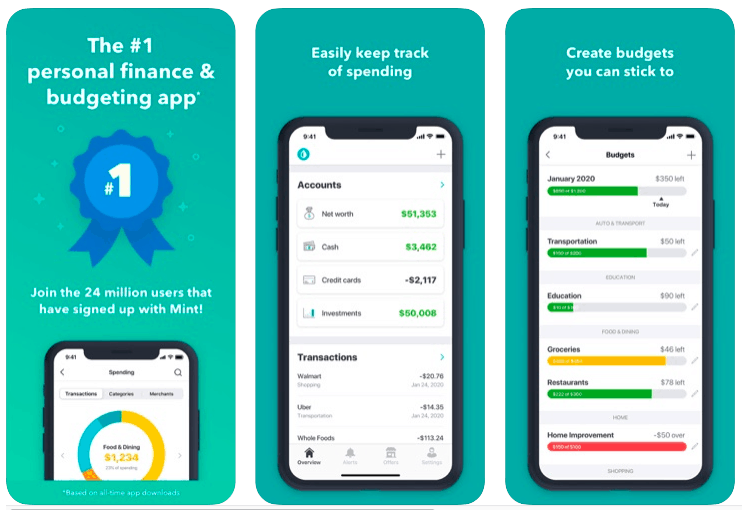

- Budgeting apps (e.g., Mint, YNAB, EveryDollar)

- Investment platforms (e.g., Robinhood, Acorns, Stash)

- Tax preparation software (e.g., TurboTax, H&R Block, TaxSlayer)

- Credit monitoring services (e.g., Credit Karma, Experian, TransUnion)

- Financial planning software (e.g., Quicken, Moneydance, GnuCash)

Compatibility with Devices and Platforms

Most financial advisor apps are compatible with the following devices and platforms:

- iOS devices (e.g., iPhone, iPad, Apple Watch)

- Android devices (e.g., Samsung Galaxy, Google Pixel, OnePlus)

- Desktop platforms (e.g., Windows, macOS, Linux)

- Web browsers (e.g., Chrome, Safari, Firefox)

Trends and Future of Financial Advisor Apps

Financial advisor apps are poised for continued growth and innovation in the years to come. As technology advances, we can expect to see even more sophisticated and user-friendly apps that can help individuals manage their finances more effectively.

One of the most significant trends in the development of financial advisor apps is the increasing use of artificial intelligence (AI) and machine learning (ML). These technologies can be used to automate tasks, provide personalized recommendations, and detect fraud. For example, AI-powered apps can analyze a user’s spending habits and identify areas where they can save money.

They can also provide personalized investment advice based on the user’s risk tolerance and financial goals.

Security and Data Protection, Financial advisor apps

As financial advisor apps become more popular, it is important to ensure that they are secure and protect user data. This includes implementing strong encryption measures and following best practices for data security. Financial advisor apps should also be regularly audited to ensure that they are compliant with all applicable regulations.

Final Thoughts

As technology continues to advance, financial advisor apps will become even more sophisticated, offering even greater personalization and convenience. By embracing these innovative tools, you can unlock the potential of your finances and secure a brighter financial future.

Detailed FAQs

What are the benefits of using financial advisor apps?

Financial advisor apps offer a range of benefits, including personalized financial advice, automated investment management, budgeting tools, and security features.

How do financial advisor apps personalize financial advice?

Financial advisor apps use algorithms to analyze your financial situation, goals, and risk tolerance. This information is then used to generate personalized recommendations and investment strategies.

Are financial advisor apps secure?

Yes, financial advisor apps typically implement robust security measures to protect user data. These measures include encryption, two-factor authentication, and compliance with industry standards.