In the ever-evolving financial landscape, Investment apps have emerged as indispensable tools for investors seeking to navigate the complexities of modern markets. These mobile and web-based platforms offer a wealth of features and functionalities, empowering users to manage their investments, make informed decisions, and achieve their financial goals.

From beginner-friendly platforms to advanced trading tools, the world of Investment apps is vast and diverse. This comprehensive guide will delve into the intricacies of these apps, exploring their types, features, security measures, and the latest industry trends. Whether you’re a seasoned investor or just starting your financial journey, this exploration will equip you with the knowledge and insights necessary to make informed choices and maximize your investment potential.

Investment App Overview

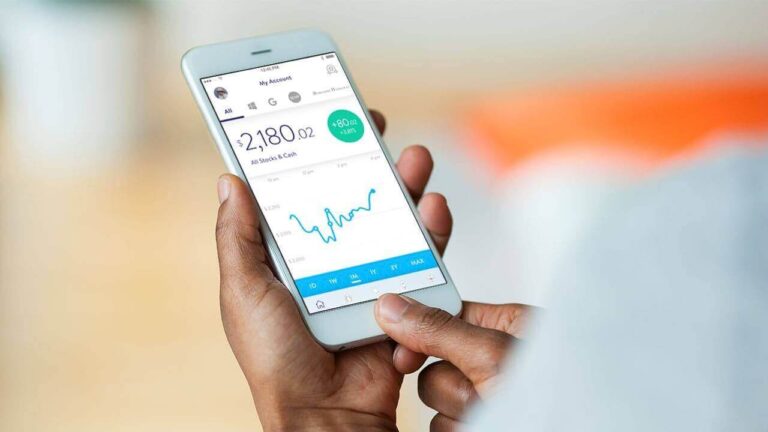

Investment apps are mobile applications that allow users to manage their investments and track their financial goals. They provide a user-friendly interface and make it easy for individuals to invest in stocks, bonds, mutual funds, and other financial products.

Some popular investment apps include Robinhood, Acorns, and Stash. These apps offer a variety of features, such as:

- Easy account setup and funding

- Access to a wide range of investment options

- Real-time market data and charting

- Personalized investment recommendations

- Educational resources and support

Investment App Benefits

Investment apps offer several benefits for users, including:

- Convenience:Investment apps make it easy to invest from anywhere, at any time.

- Affordability:Many investment apps offer low or no fees, making them accessible to a wider range of investors.

- Education:Investment apps often provide educational resources and support, helping users learn about investing and make informed decisions.

Types of Investment Apps

Investment apps cater to diverse audiences and employ varied investment strategies. Each type offers unique advantages and drawbacks, shaping their suitability for different investors.

Investment apps can be broadly categorized based on their target audience and investment approach:

Robo-Advisors

- Automated investment management services tailored for beginners and passive investors.

- Use algorithms to create and manage diversified portfolios based on individual risk tolerance and financial goals.

- Advantages: Low fees, accessibility, and hands-off approach.

- Disadvantages: Limited customization options, potential for suboptimal returns compared to active management.

Self-Directed Brokerage Apps

- Platforms that empower investors to manage their own portfolios.

- Offer a wide range of investment options, including stocks, bonds, ETFs, and mutual funds.

- Advantages: Extensive control over investment decisions, potential for higher returns.

- Disadvantages: Require investment knowledge and time commitment, higher fees.

Micro-Investing Apps

- Designed for investors with limited capital or who want to invest in fractional shares.

- Allow users to invest small amounts of money regularly.

- Advantages: Accessibility, encourages saving habits.

- Disadvantages: May have higher fees, limited investment options.

Socially Responsible Investing Apps

- Focus on investments that align with environmental, social, and governance (ESG) criteria.

- Provide options for investors seeking to make a positive impact while earning returns.

- Advantages: Ethical investing, potential for long-term returns.

- Disadvantages: Limited investment universe, potentially lower returns compared to traditional investments.

Theme-Based Investing Apps

- Curate portfolios around specific themes, such as technology, healthcare, or renewable energy.

- Offer exposure to emerging trends and industries.

- Advantages: Potential for high returns, diversification within a theme.

- Disadvantages: Narrow investment focus, higher risk.

Features and Functionality

Investment apps offer a range of features designed to enhance the user experience and support informed investment decisions. These features include:

- Account Management:

- Account creation and management

- Real-time account balance and portfolio performance tracking

- Deposit and withdrawal options

- Trading Tools:

- Access to real-time market data and charts

- Order placement and execution

- Stop-loss and take-profit orders

- Technical and fundamental analysis tools

- Educational Resources:

- Articles, videos, and webinars on investing basics

- Investment strategies and market analysis

- Access to financial experts

These features empower users to manage their investments, make informed trading decisions, and enhance their financial knowledge.

Security and Regulations: Investment Apps

Investment apps prioritize user data and financial transaction security through robust security measures. These include:* Encryption: Sensitive data is encrypted at rest and in transit, safeguarding it from unauthorized access.

Multi-factor authentication

Additional security layers are added to login processes, such as SMS verification or biometrics.

Fraud detection systems

Advanced algorithms monitor transactions for suspicious activity, preventing unauthorized withdrawals or account takeovers.

Regulatory Frameworks, Investment apps

Investment apps operate within regulatory frameworks to ensure user safety:* Securities and Exchange Commission (SEC):Regulates the sale of securities and investment products, ensuring transparency and investor protection.

Financial Industry Regulatory Authority (FINRA)

Oversees broker-dealers, including those offering investment apps, enforcing ethical conduct and fair market practices.

Commodity Futures Trading Commission (CFTC)

Regulates futures and options trading, including those accessible through investment apps, protecting investors from fraud and market manipulation.These regulations require investment apps to:* Register with the relevant authorities

- Adhere to disclosure and reporting requirements

- Maintain financial stability and adequate capital reserves

- Implement robust cybersecurity measures

Compliance with these regulations enhances user confidence in investment apps and ensures the integrity of financial transactions.

Fees and Pricing

Investment apps typically charge a range of fees that can affect the overall investment experience. Understanding these fees is crucial for making informed decisions about which app to use.

The most common fee models include:

- Trading fees:These are charged for each trade executed, typically as a percentage of the trade value.

- Management fees:Ongoing fees charged as a percentage of the assets under management (AUM), usually on an annual basis.

- Account fees:Fixed fees charged for maintaining an account, regardless of trading activity.

- Withdrawal fees:Fees charged for withdrawing funds from an investment account.

Impact on Investment Experience

Fees can significantly impact the overall investment experience in several ways:

- Reduced returns:Fees eat into investment returns, especially over the long term.

- Limited investment options:Some apps may offer lower fees for certain types of investments, limiting investment choices.

- Inactivity penalties:Some apps charge fees for inactivity, discouraging long-term investing.

It’s important to carefully consider the fee structure of an investment app before making a decision, as fees can have a significant impact on the profitability and flexibility of your investments.

User Experience

Investment apps are designed to provide a user-friendly experience that simplifies investing for both beginners and experienced investors. The user interface (UI) is typically intuitive, with clear navigation menus and straightforward functionality.

User-friendly designs contribute significantly to the overall experience and engagement of investment apps. A well-designed app should make it easy for users to find the information they need, track their investments, and make informed decisions.

User Interface

- The UI of investment apps is typically clean and uncluttered, with a focus on simplicity and ease of use.

- Navigation menus are usually located at the top or bottom of the screen, providing quick access to different sections of the app.

- Dashboards often display key information about investments, such as account balances, performance charts, and recent transactions.

User-Friendly Features

- Investment apps often offer user-friendly features such as tutorials, FAQs, and in-app support to help users get started and resolve any issues they may encounter.

- Many apps also provide educational resources, such as articles, videos, and webinars, to help users learn more about investing.

- Some apps even offer personalized recommendations and automated investment strategies to help users achieve their financial goals.

Customer Support

Customer support is crucial in investment apps as it assists users with various queries and issues they may encounter while managing their investments. Effective customer support channels provide users with peace of mind and confidence in the app’s reliability.Different types of support channels offered by investment apps include:

Live Chat

Live chat is an efficient and convenient support channel that allows users to connect with a customer support representative in real-time. It provides immediate assistance for urgent queries and helps resolve issues quickly.

Email Support

Email support is a traditional and reliable support channel where users can send detailed queries and receive responses within a specified timeframe. It is suitable for non-urgent inquiries or when users require comprehensive explanations.

Phone Support

Phone support offers personalized assistance where users can speak directly with a customer support representative. It is particularly useful for complex queries that require in-depth troubleshooting or explanations.

Help Center

A help center is a comprehensive resource that provides users with access to FAQs, tutorials, and other self-help materials. It empowers users to resolve common issues independently and reduces the need for direct support.

Market Trends and Future Developments

The investment app industry is constantly evolving, driven by technological advancements and changing consumer demands. Emerging trends and potential innovations are shaping the future of investment apps, offering new opportunities and challenges for investors and app developers alike.

One significant trend is the rise of personalized investment recommendations. Artificial intelligence (AI) and machine learning (ML) algorithms are being used to analyze individual investor profiles, risk tolerance, and financial goals. This enables investment apps to provide tailored investment recommendations that are specific to each user’s needs and circumstances.

Gamification

Gamification is another growing trend in the investment app industry. By incorporating game-like elements such as rewards, leaderboards, and progress tracking, investment apps can make investing more engaging and accessible to a wider audience. This can be particularly beneficial for younger investors who may not have a lot of prior investment experience.

Robo-advisors

Robo-advisors are automated investment platforms that use algorithms to manage portfolios based on individual investor profiles. These platforms offer a low-cost and convenient way for investors to access professional investment advice and portfolio management services. As technology continues to improve, robo-advisors are becoming increasingly sophisticated and offering a wider range of investment options.

Cryptocurrency Integration

The growing popularity of cryptocurrencies is also having an impact on the investment app industry. Many investment apps are now integrating cryptocurrency trading and custody services, allowing investors to buy, sell, and hold cryptocurrencies alongside traditional investments. This trend is expected to continue as cryptocurrencies become more widely accepted and regulated.

Environmental, Social, and Governance (ESG) Investing

ESG investing, which considers environmental, social, and governance factors in investment decisions, is becoming increasingly popular among investors. Investment apps are responding to this demand by offering ESG-focused investment options and tools that help investors align their investments with their values.

Final Summary

As the future of investing continues to unfold, Investment apps will undoubtedly play an increasingly pivotal role. With their user-centric designs, innovative features, and unwavering commitment to security, these platforms are transforming the way we interact with financial markets. By embracing the power of Investment apps, investors can unlock a world of opportunities and confidently navigate the ever-changing landscape of modern finance.

Answers to Common Questions

What are the benefits of using Investment apps?

Investment apps offer numerous benefits, including convenience, accessibility, affordability, personalized investment recommendations, and educational resources.

How do I choose the right Investment app for me?

Consider your investment goals, risk tolerance, experience level, and the features and fees offered by different apps to make an informed decision.

Are Investment apps safe and secure?

Reputable Investment apps employ robust security measures, including encryption, two-factor authentication, and regulatory compliance, to protect user data and financial transactions.