In the realm of personal finance, Financial planning apps emerge as indispensable tools, empowering individuals to take control of their financial well-being. These innovative apps offer a comprehensive suite of features that simplify budgeting, automate savings, and provide personalized financial guidance.

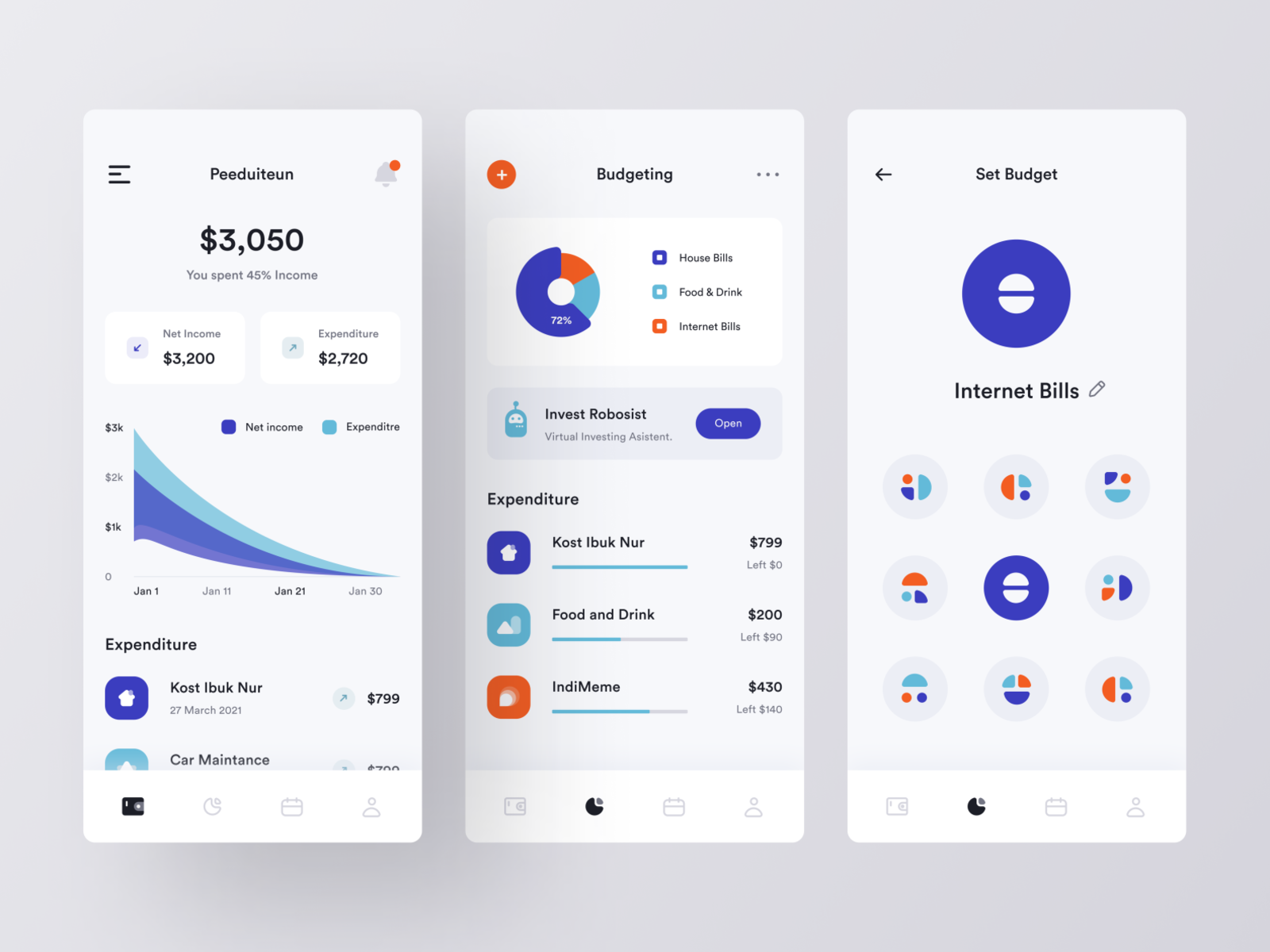

With their user-friendly interfaces and robust functionality, financial planning apps cater to a diverse range of users, from those seeking to manage their daily expenses to those planning for long-term financial security. By leveraging the power of technology, these apps empower users to make informed financial decisions, achieve their financial goals, and ultimately live a more financially fulfilling life.

Overview of Financial Planning Apps

Financial planning apps are software applications designed to help individuals manage their personal finances. They provide a range of features to assist users in budgeting, tracking expenses, setting financial goals, and making informed investment decisions.

Key benefits of using financial planning apps include:

- Automated budgeting and expense tracking

- Personalized financial insights and recommendations

- Access to financial advice and support

- Improved financial literacy and decision-making

Types of Financial Planning Apps

There are several types of financial planning apps available, each tailored to specific user needs:

- Budgeting and Expense Tracking Apps:Focus on helping users create and manage budgets, track expenses, and identify areas for improvement.

- Investment Tracking Apps:Allow users to monitor their investment portfolios, track performance, and make informed trading decisions.

- Retirement Planning Apps:Assist users in planning for retirement, estimating retirement income needs, and maximizing retirement savings.

- Comprehensive Financial Planning Apps:Offer a comprehensive suite of features, including budgeting, investment tracking, retirement planning, and financial advice.

How Financial Planning Apps Work

Financial planning apps are designed to help you manage your money and make informed financial decisions. They typically offer a range of features, including budgeting, tracking expenses, setting financial goals, and investing.To get started with a financial planning app, you’ll first need to create an account and link your financial accounts.

Once you’ve done this, the app will be able to track your income, expenses, and investments.

How Financial Planning Apps Connect to Financial Accounts

Financial planning apps use a variety of methods to connect to financial accounts. Some apps use a direct connection, which means that they will ask you for your login credentials for each of your financial accounts. Other apps use a read-only connection, which means that they will only be able to access your account information, not make any changes.

Security Measures in Place to Protect User Data

Financial planning apps take a number of steps to protect user data. These measures include:

- Encryption: All data is encrypted at rest and in transit.

- Multi-factor authentication: Users are required to provide multiple forms of identification, such as a password and a security code sent to their phone, when they log in to their account.

- Regular security audits: Apps are regularly audited by independent security firms to ensure that they are meeting the highest security standards.

Benefits of Using Financial Planning Apps

Financial planning apps have gained popularity as valuable tools for individuals seeking to manage their finances effectively. These apps offer numerous benefits that can assist users in achieving their financial goals.

Improved Budgeting and Expense Tracking

Financial planning apps provide comprehensive budgeting features that help users track their income and expenses in real-time. By categorizing transactions and visualizing spending patterns, these apps empower users to identify areas where they can save money and make informed financial decisions.

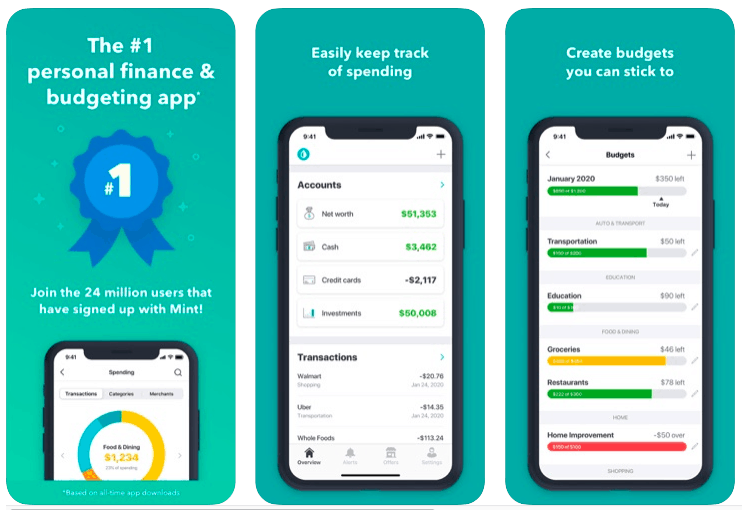

- Example: The Mint app allows users to connect their financial accounts and automatically categorize transactions, providing a clear overview of their spending habits.

Automated Savings and Investment

Financial planning apps often offer automated savings and investment features that make it easy for users to build wealth over time. By setting up recurring transfers or round-ups on purchases, these apps help users save money without requiring conscious effort.

- Example: The Acorns app allows users to invest spare change from everyday purchases, automatically investing the accumulated funds in a diversified portfolio.

Personalized Financial Advice

Some financial planning apps provide personalized financial advice tailored to the user’s financial situation and goals. These apps use algorithms to analyze spending patterns, identify areas for improvement, and offer tailored recommendations.

- Example: The Betterment app offers personalized investment portfolios based on the user’s risk tolerance and financial goals.

Choosing the Right Financial Planning App

Selecting the optimal financial planning app hinges upon meticulously evaluating specific criteria:

Features and Functionality

Scrutinize the app’s features and ensure alignment with your financial goals. Essential features include:

- Budgeting tools for expense tracking and categorization

- Investment tracking for monitoring portfolio performance

- Goal setting and tracking for visualizing financial aspirations

- Debt management for consolidating and repaying outstanding debts

- Tax planning tools for optimizing tax strategies

Cost and Fees, Financial planning apps

Consider the cost structure of different apps. Some offer free basic services, while others charge monthly or annual subscription fees. Evaluate the value proposition and determine if the app’s features justify the associated costs.

User Interface and Ease of Use

The app’s user interface should be intuitive and user-friendly. A well-designed app enhances the user experience and encourages consistent engagement with financial planning tasks.

To assist in your decision-making process, the following table provides a comparison of popular financial planning apps, highlighting their key features and pricing:

| App | Features | Cost |

|---|---|---|

| Mint | Budgeting, investment tracking, goal setting | Free (basic); $9.99/month (premium) |

| YNAB (You Need a Budget) | Zero-based budgeting, debt management | $11.99/month; $89/year |

| PocketGuard | Budgeting, expense tracking, bill reminders | Free (basic); $7.99/month (premium) |

| Personal Capital | Investment tracking, retirement planning, net worth analysis | Free (basic); $299/year (premium) |

| Goodbudget | Envelope-based budgeting, collaborative planning | $7/month; $80/year |

Getting Started with a Financial Planning App

Getting started with a financial planning app is a simple and straightforward process that can help you take control of your finances. Here are the steps to follow:

Setting Up an Account

- Download the app from the App Store or Google Play.

- Create an account by providing your email address and creating a password.

- Verify your email address by clicking on the link sent to your inbox.

Connecting Financial Accounts

- Once you have created an account, you will need to connect your financial accounts to the app.

- This will allow the app to track your income, expenses, and investments.

- To connect an account, enter your login credentials and follow the prompts.

Customizing Settings

- Once your financial accounts are connected, you can customize the app’s settings to meet your needs.

- This includes setting up budgets, creating goals, and tracking your progress.

- You can also customize the app’s appearance and notifications.

Tips for Getting the Most Out of a Financial Planning App

- Set realistic goals and budgets.

- Track your progress regularly and make adjustments as needed.

- Use the app’s features to create a comprehensive financial plan.

- Seek professional advice if you need help with your finances.

By following these steps, you can get started with a financial planning app and start taking control of your finances.

Case Studies and Success Stories

Financial planning apps have empowered numerous individuals and businesses to transform their financial lives. These apps provide personalized guidance, automate tasks, and offer insights that enable users to make informed financial decisions.

Paying Off Debt

A prime example is Emily, a young professional who struggled with high-interest credit card debt. Using a financial planning app, she created a budget, tracked her expenses, and set up automated payments to prioritize debt repayment. Within a year, Emily paid off her entire debt, saving thousands of dollars in interest and improving her credit score.

Saving for Retirement

John, a small business owner, utilized a financial planning app to establish a retirement savings plan. The app analyzed his income and expenses, recommended investment strategies, and automated regular contributions to his retirement account. Over time, John’s retirement savings grew significantly, providing him with financial security for his future.

Building an Emergency Fund

Sarah, a single mother, was determined to create an emergency fund to protect her family against unexpected expenses. A financial planning app helped her set a savings goal, track her progress, and identify areas where she could reduce spending. Within six months, Sarah had built a substantial emergency fund, giving her peace of mind and financial resilience.

Final Review: Financial Planning Apps

In conclusion, Financial planning apps are transformative tools that empower individuals to take charge of their financial future. By harnessing the power of technology, these apps provide a personalized and accessible approach to financial management. Whether you’re looking to streamline your budgeting, automate your savings, or seek expert financial advice, there’s a financial planning app tailored to your specific needs.

Embrace the benefits of these innovative apps and embark on a journey towards financial freedom and prosperity.

User Queries

What are the key features of financial planning apps?

Financial planning apps typically offer a range of features, including budgeting tools, expense tracking, automated savings, investment tracking, and personalized financial advice.

How do financial planning apps connect to financial accounts?

Financial planning apps use secure methods to connect to financial accounts, such as OAuth and Plaid. These connections allow the apps to retrieve transaction data and account balances.

Are financial planning apps secure?

Yes, reputable financial planning apps employ robust security measures, including encryption and multi-factor authentication, to protect user data and prevent unauthorized access.