Mortgage calculator apps are revolutionizing the homebuying process, providing homebuyers with the power to make informed financial decisions and navigate the complex world of mortgages with ease.

These indispensable tools offer a wealth of features and benefits, simplifying the mortgage application process and empowering users with the knowledge they need to make sound financial choices.

Mortgage Calculator App Features

Mortgage calculator apps provide users with a convenient way to estimate their monthly mortgage payments and explore different loan options. These apps typically offer a range of features to help users make informed decisions about their mortgage.

Common Features

Common features found in mortgage calculator apps include:

- Ability to calculate monthly mortgage payments based on loan amount, interest rate, and loan term

- Option to compare different loan scenarios by adjusting the loan amount, interest rate, or loan term

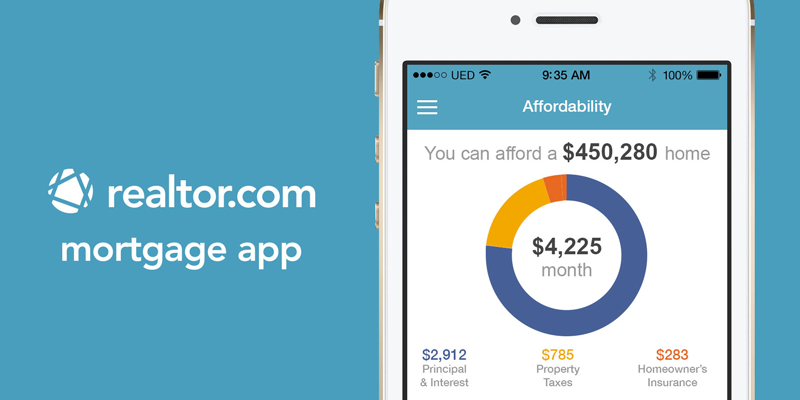

- Detailed breakdown of monthly payments, including principal, interest, taxes, and insurance (PITI)

- Amortization schedule that shows how the loan balance will change over time

- Ability to save and share loan scenarios for future reference

Advanced Features

Some mortgage calculator apps offer advanced features that differentiate them from one another. These features may include:

- Ability to calculate bi-weekly mortgage payments

- Option to factor in additional expenses, such as homeowners insurance and private mortgage insurance (PMI)

- Detailed graphs and charts that visualize the loan repayment process

- Integration with other financial tools, such as budgeting apps

- Access to real-time mortgage rates from multiple lenders

Unique Features, Mortgage calculator apps

Some mortgage calculator apps offer unique or innovative features that enhance the user experience. These features may include:

- Ability to scan and upload loan documents to automatically populate loan information

- Integration with credit score tracking services

- Personalized recommendations for loan options based on the user’s financial profile

- Educational resources and articles about mortgages and homeownership

- Community forums where users can connect with other homeowners and experts

Benefits of Using Mortgage Calculator Apps

Mortgage calculator apps offer numerous advantages over manual calculations, simplifying the mortgage application process and providing convenience and accessibility.

Simplified Mortgage Application Process

Mortgage calculator apps streamline the mortgage application process by automating complex calculations. They eliminate the need for manual calculations, reducing the risk of errors and saving time. Apps guide users through each step, ensuring accuracy and reducing the likelihood of delays or rejections due to incorrect calculations.

Convenience and Accessibility

Mobile mortgage calculator apps offer unmatched convenience and accessibility. Users can access them anytime, anywhere, with just a few taps on their smartphones. This allows for quick and easy calculations on the go, whether users are at home, at work, or even at the property they’re considering purchasing.

The portability of mobile apps makes it easier to compare different mortgage options and make informed decisions.

Factors to Consider When Choosing a Mortgage Calculator App

When selecting a mortgage calculator app, several key factors should be considered to ensure accuracy, ease of use, and reliability.

Accuracy

The accuracy of a mortgage calculator app is paramount. Inaccurate calculations can lead to incorrect loan estimates and financial decisions. Look for apps that use industry-standard formulas and are regularly updated to reflect changes in mortgage rates and regulations.

Ease of Use

A mortgage calculator app should be easy to navigate and understand. A user-friendly interface with clear instructions and intuitive controls makes it easier to input information and obtain accurate results.

Customization Options

Mortgage calculator apps should offer customization options to tailor calculations to individual needs. This includes the ability to adjust loan terms, such as the loan amount, interest rate, and loan duration, as well as the ability to include additional expenses, such as property taxes and insurance.

Reliability and Security

The reliability and security of a mortgage calculator app are crucial. Choose apps from reputable developers with a proven track record of accuracy and data protection. Look for apps that use encryption and other security measures to protect sensitive financial information.

Types of Mortgage Calculator Apps

Mortgage calculator apps can be broadly classified into three main categories: basic calculators, advanced calculators, and specialized calculators. Each type of app is designed to meet specific needs and target audiences.

Basic Calculators

Basic mortgage calculators provide essential functions for calculating monthly payments and other basic loan parameters. They typically include options for inputting loan amount, interest rate, loan term, and down payment. These calculators are suitable for users who need a quick and straightforward estimate of their monthly mortgage payments.

Advanced Calculators

Advanced mortgage calculators offer more comprehensive features than basic calculators. They may include options for calculating amortization schedules, comparing different loan scenarios, and factoring in additional expenses such as property taxes and insurance. These calculators are ideal for users who want a more detailed understanding of their mortgage payments and long-term financial implications.

Specialized Calculators

Specialized mortgage calculators are designed to meet specific needs, such as calculating affordability, refinancing options, or reverse mortgages. These calculators often include additional features tailored to the specific calculation they are intended for. They are suitable for users who have unique or complex mortgage-related needs.

Mortgage Calculator App Market Analysis

The mortgage calculator app market is experiencing significant growth due to the increasing popularity of mobile devices and the need for financial planning tools. The convenience and accessibility of these apps have made them indispensable for homebuyers and homeowners alike.

According to a report by Allied Market Research, the global mortgage calculator app market is projected to reach $1.2 billion by 2027, growing at a CAGR of 6.3% from 2021 to 2027. The increasing adoption of smartphones and tablets, coupled with the rising demand for personalized financial solutions, is driving the growth of this market.

Key Players

The key players in the mortgage calculator app market include:

- Bank of America

- Wells Fargo

- Chase

- Zillow

- Trulia

These companies offer a wide range of mortgage calculator apps that cater to the diverse needs of users. They provide features such as personalized calculations, interest rate comparisons, and affordability assessments, making them essential tools for anyone considering a mortgage.

User Engagement

Mortgage calculator apps have high user engagement rates due to their ease of use and convenience. Users can quickly and easily calculate their monthly payments, compare different loan options, and explore various scenarios to find the best mortgage for their needs.

According to a study by Flurry Analytics, mortgage calculator apps are among the most popular financial apps in the United States. They are used by millions of people each month, demonstrating their widespread adoption and utility.

Industry Projections

The future of the mortgage calculator app market is bright, with continued growth expected in the coming years. The increasing penetration of smartphones and the growing demand for financial planning tools will drive the adoption of these apps.

Additionally, the emergence of new technologies, such as artificial intelligence (AI) and machine learning (ML), is expected to enhance the capabilities of mortgage calculator apps. These technologies can provide personalized recommendations, automate calculations, and improve the overall user experience.

Design Considerations for Mortgage Calculator Apps

User interface design is crucial for mortgage calculator apps, as it directly impacts user experience and satisfaction. An intuitive and visually appealing interface makes it easy for users to navigate the app and perform calculations, while a poorly designed interface can lead to confusion and frustration.Best practices for creating intuitive and visually appealing interfaces include:

- Using clear and concise language

- Providing visual cues to guide users through the process

- Avoiding clutter and unnecessary elements

- Using a consistent design throughout the app

- Testing the app with users to get feedback on the design

It’s also important to optimize apps for different screen sizes and devices. With the increasing popularity of mobile devices, it’s essential to ensure that the app is easy to use on both smartphones and tablets. This may involve creating different layouts for different screen sizes or using responsive design techniques.

Mortgage Calculator App Integrations

Integrating mortgage calculator apps with other financial tools enhances their functionality and value. By connecting with budgeting apps, users can track their expenses and ensure their mortgage payments fit within their overall financial plan. Integration with home search apps allows users to calculate mortgage payments for potential homes, making the home-buying process more informed.

Partnerships and Collaborations

Potential partnerships and collaborations within the industry include alliances with real estate agents, mortgage brokers, and financial advisors. These collaborations can provide access to valuable data, expertise, and a wider customer base.

Future of Mortgage Calculator Apps

Mortgage calculator apps are poised to undergo significant advancements in the coming years, driven by emerging technologies and evolving industry trends.

Artificial intelligence (AI) and machine learning (ML) are expected to play a transformative role in mortgage calculator apps, enabling them to provide personalized and tailored experiences for users.

AI and ML-Powered Features

- Automated underwriting and loan approval processes, reducing processing times and improving efficiency.

- Personalized mortgage recommendations based on individual financial profiles and preferences.

- Predictive analytics to forecast future mortgage rates and market trends.

- Virtual assistants that provide real-time support and guidance throughout the mortgage application process.

Additionally, the evolving mortgage landscape is creating new opportunities for mortgage calculator apps.

Role in Evolving Mortgage Landscape

- Integration with home search platforms, allowing users to seamlessly explore mortgage options while searching for properties.

- Collaboration with mortgage lenders to provide real-time rate comparisons and pre-approvals.

- Support for alternative mortgage products, such as adjustable-rate mortgages (ARMs) and interest-only loans.

By embracing these advancements, mortgage calculator apps will continue to play a vital role in empowering homebuyers and homeowners to make informed decisions throughout their mortgage journey.

Final Conclusion

As the mortgage industry continues to evolve, mortgage calculator apps will undoubtedly play an increasingly vital role, empowering homebuyers with the tools they need to make informed decisions and achieve their homeownership dreams.

Essential FAQs: Mortgage Calculator Apps

What are the key features to look for in a mortgage calculator app?

Accuracy, ease of use, customization options, advanced features (e.g., amortization schedules, different loan types), and integration with other financial tools.

How do mortgage calculator apps benefit homebuyers?

They simplify calculations, provide personalized estimates, allow for scenario comparisons, and enhance financial literacy.

What are the different types of mortgage calculator apps available?

Basic calculators, advanced calculators, specialized calculators (e.g., FHA loan calculators, VA loan calculators).